To Tax or not to Tax...that is the question (for Florida residents)...

The new proposal being put forth by Florida legislators will effectively ERADICATE the property tax while raising the state sales tax. On the surface, it's a great idea. However, there will be ramifications that need to be considered.

First let me say that I support any legilation that will decrease the burden of every homeowner while not short-changing the residents of Florida. I have a $4900 tax - it has become extremely burdensome and has made me consider down-sizing and, possibly, renting. Before I pay my mortgage, I will spend $667 EVERY MONTH for insurance and taxes alone!

I will leave the number-crunching to the CPA's in Tallahassee. I will, however, offer this nugget - I have no problem paying 50%, 33%, or 25% of my current tax bill. I should pay taxes based on the size and value of my home. Conversely, I would prefer to see only a 50%, 66% or 75% raise of the proposed 3% increase to our state's sales tax. I do not believe the decision to revamp our state tax system should be so exetreme as to totally eliminate 1 form of taxation for another form.

Let's take emotion out of the decision, explore ALL of the cause-and-effect relationships, and make a sound decision for the resident's of this great state that will praised 10 years from now.

My $.02...

Monday, February 26, 2007

Monday, February 19, 2007

A pebble tossed into a pond creates ripples that, although not felt immediately, will in time reach it's intended point...

I have just personally seen that simple thought demonstrated in real life, as it pertains to the Insurance Crisis in Florida!

Barbara (the innocent shall be protected) works as an Office Manager. Last December, she was informed by Liberty Mutual, her insurance company OF 20 YEARS that her and her husband's policy on a non-waterfront, single family ranch home was being "non-renewed"...insurance jargon for C-A-N-C-E-L-E-D. Keep in mind she has NEVER made a claim on her insurance - they have faithfully paid their ever-expanding insurance premiums dutifully and without complaint.

Then, the letter of non-renewal arrived. Barbara went into a freefall as she desperately contacted insurance agents and companies across Florida, all with the same result: Citizens coverage ONLY. With no hope of getting a private carrier, Barbara and her husband resigned themselves to try their best to pay the high premiums Citizens requires. Adding insult to injury is that their coverage with Citizens was LESS than Liberty but cost MORE! On January 30th, Barbara and her family's home insurance policy through Liberty Mutual was canceled.

This morning (2/19), Barbara received a phone call from her Liberty Mutual insurance agent. Lo and behold, Barbara's policy WOULD be renewed by Liberty Mutual. The reason: CS/CS/SB 1980. That's the bill signed into law on January 30th by Governor Charlie Crist, on the exact day Barbara was non-renewed! In fact, her agent said, that was the ONLY reason she was being given a second chance - anyone who's policy was non-renewed on January 29th or earlier was simply out of luck.

Although the ripple from the pebble took awhile to arrive, help is on the way - have patience and faith!

I have just personally seen that simple thought demonstrated in real life, as it pertains to the Insurance Crisis in Florida!

Barbara (the innocent shall be protected) works as an Office Manager. Last December, she was informed by Liberty Mutual, her insurance company OF 20 YEARS that her and her husband's policy on a non-waterfront, single family ranch home was being "non-renewed"...insurance jargon for C-A-N-C-E-L-E-D. Keep in mind she has NEVER made a claim on her insurance - they have faithfully paid their ever-expanding insurance premiums dutifully and without complaint.

Then, the letter of non-renewal arrived. Barbara went into a freefall as she desperately contacted insurance agents and companies across Florida, all with the same result: Citizens coverage ONLY. With no hope of getting a private carrier, Barbara and her husband resigned themselves to try their best to pay the high premiums Citizens requires. Adding insult to injury is that their coverage with Citizens was LESS than Liberty but cost MORE! On January 30th, Barbara and her family's home insurance policy through Liberty Mutual was canceled.

This morning (2/19), Barbara received a phone call from her Liberty Mutual insurance agent. Lo and behold, Barbara's policy WOULD be renewed by Liberty Mutual. The reason: CS/CS/SB 1980. That's the bill signed into law on January 30th by Governor Charlie Crist, on the exact day Barbara was non-renewed! In fact, her agent said, that was the ONLY reason she was being given a second chance - anyone who's policy was non-renewed on January 29th or earlier was simply out of luck.

Although the ripple from the pebble took awhile to arrive, help is on the way - have patience and faith!

Monday, February 12, 2007

THIS IS IT!!!

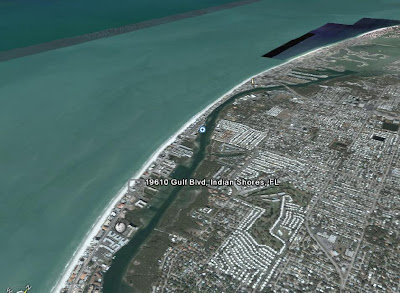

This 2/2 condo is ON THE GULF OF MEXICO, has great rental income (weekly rental), low Monthly Maintenance Fee ($295), and is in pre-foreclosure. The owner purchased the property for $533,000 in ’05 and is now selling it for a loss at $499,000. Email me for a Buyer info sheet and a satellite image of the condo’s Gulf-front location.

If you need more info, please call or email me. Don’t wait if you’re interested!

This 2/2 condo is ON THE GULF OF MEXICO, has great rental income (weekly rental), low Monthly Maintenance Fee ($295), and is in pre-foreclosure. The owner purchased the property for $533,000 in ’05 and is now selling it for a loss at $499,000. Email me for a Buyer info sheet and a satellite image of the condo’s Gulf-front location.

If you need more info, please call or email me. Don’t wait if you’re interested!

Monday, February 05, 2007

The Fair Housing Act helps protect people from discrimination when they seek to purchase or rent real estate.

First passed on April 11, 1968, the law prohibits discrimination based on race or color, religion, sex, and national origin. In 1988, the Fair Housing Act was amended to include protection for people with disabilities and people with children under the age of 18. As REALTORS®, we hold the key to ensuring the American Dream of homeownership is available to all. By learning as much as you can about Fair Housing, you will help ensure fairness in our marketplace.

Unfortunately, common sense is only attained the hard way sometimes, so the Fair Housing code mentions some specific examples that have already met the complaint test:

Race, color, national origin. Real estate advertisements should state no discriminatory preference or limitation on account of race, color, or national origin. Use of words describing the housing, the current or potential residents, or the neighbors or neighborhood in racial or ethnic terms (i.e, white family home, no Irish) will create liability under this section.

However, advertisements which are facially neutral will not create liability. Thus, complaints over use of phrases such as 'master bedroom,' 'rare find,' or 'desirable neighborhood' should not filed.

Religion. Advertisements should not contain an explicit preference, limitation or discrimination on account of religion (i.e. no Jews, Christian home). Advertisements which use the legal name of an entity which contains a religious reference (for example, Roselawn Catholic Home), or those which contain a religious symbol, (such as a cross), standing alone, may indicate religious preference. However, if such an advertisement includes a disclaimer (such as the statement "This Home does not discriminate on the basis of race, color, religion, national origin, sex, handicap or familial status") it will not violate the Act. Advertisements containing descriptions of properties (apartment complex with chapel), or services (kosher meals available) do not on their face state a preference for persons likely to make use of those facilities, and are not violations of the Act. The use of secularized terms or symbols relating to religious holidays such as Santa Claus, Easter Bunny, or St.Valentine's Day images, or phrases such as Merry Christmas, Happy Easter, or the like does not constitute a violation of the Act.

Sex. Advertisements for single family dwellings or separate units in a multi-family dwelling should contain no explicit preference, limitation or discrimination based on sex. Use of the term master bedroom does not constitute a violation of either the sex discrimination provisions or the race discrimination provisions. Terms such as "mother-in-law suite" and "bachelor apartment" are commonly used as physical descriptions of housing units and do not violate the Act.

Handicap. Real estate advertisements should not contain explicit exclusions, limitations, or other indications of discrimination based on handicap (i.e., no wheelchairs). Advertisements containing descriptions of properties (great view, fourth-floor walk-up, walk-in closets), services or facilities (jogging trails), or neighborhoods (walk to bus-stop) do not violate the Act. Advertisements describing the conduct required of residents ("non-smoking", "sober") do not violate the Act. Advertisements containing descriptions of accessibility features are lawful (wheelchair ramp).

Familial status. Advertisements may not state an explicit preference, limitation or discrimination based on familial status. Advertisements may not contain limitations on the number or ages of children, or state a preference for adults, couples or singles. Advertisements describing the properties (two bedroom, cozy, family room), services and facilities (no bicycles allowed) or neighborhoods (quiet streets) are not facially discriminatory and do not violate the Act.

ABOVE ALL: Describe the property, not the Buyer

First passed on April 11, 1968, the law prohibits discrimination based on race or color, religion, sex, and national origin. In 1988, the Fair Housing Act was amended to include protection for people with disabilities and people with children under the age of 18. As REALTORS®, we hold the key to ensuring the American Dream of homeownership is available to all. By learning as much as you can about Fair Housing, you will help ensure fairness in our marketplace.

Unfortunately, common sense is only attained the hard way sometimes, so the Fair Housing code mentions some specific examples that have already met the complaint test:

Race, color, national origin. Real estate advertisements should state no discriminatory preference or limitation on account of race, color, or national origin. Use of words describing the housing, the current or potential residents, or the neighbors or neighborhood in racial or ethnic terms (i.e, white family home, no Irish) will create liability under this section.

However, advertisements which are facially neutral will not create liability. Thus, complaints over use of phrases such as 'master bedroom,' 'rare find,' or 'desirable neighborhood' should not filed.

Religion. Advertisements should not contain an explicit preference, limitation or discrimination on account of religion (i.e. no Jews, Christian home). Advertisements which use the legal name of an entity which contains a religious reference (for example, Roselawn Catholic Home), or those which contain a religious symbol, (such as a cross), standing alone, may indicate religious preference. However, if such an advertisement includes a disclaimer (such as the statement "This Home does not discriminate on the basis of race, color, religion, national origin, sex, handicap or familial status") it will not violate the Act. Advertisements containing descriptions of properties (apartment complex with chapel), or services (kosher meals available) do not on their face state a preference for persons likely to make use of those facilities, and are not violations of the Act. The use of secularized terms or symbols relating to religious holidays such as Santa Claus, Easter Bunny, or St.Valentine's Day images, or phrases such as Merry Christmas, Happy Easter, or the like does not constitute a violation of the Act.

Sex. Advertisements for single family dwellings or separate units in a multi-family dwelling should contain no explicit preference, limitation or discrimination based on sex. Use of the term master bedroom does not constitute a violation of either the sex discrimination provisions or the race discrimination provisions. Terms such as "mother-in-law suite" and "bachelor apartment" are commonly used as physical descriptions of housing units and do not violate the Act.

Handicap. Real estate advertisements should not contain explicit exclusions, limitations, or other indications of discrimination based on handicap (i.e., no wheelchairs). Advertisements containing descriptions of properties (great view, fourth-floor walk-up, walk-in closets), services or facilities (jogging trails), or neighborhoods (walk to bus-stop) do not violate the Act. Advertisements describing the conduct required of residents ("non-smoking", "sober") do not violate the Act. Advertisements containing descriptions of accessibility features are lawful (wheelchair ramp).

Familial status. Advertisements may not state an explicit preference, limitation or discrimination based on familial status. Advertisements may not contain limitations on the number or ages of children, or state a preference for adults, couples or singles. Advertisements describing the properties (two bedroom, cozy, family room), services and facilities (no bicycles allowed) or neighborhoods (quiet streets) are not facially discriminatory and do not violate the Act.

ABOVE ALL: Describe the property, not the Buyer

Subscribe to:

Posts (Atom)